When recording cash payments to suppliers it is common for the cash disbursement journal to include a discounts received column. By using a discounts received column, the payments journal records the invoiced amount, the discount received, and the cash payment. In this way, the line item postings to the accounts payable ledger are for the full invoiced amount, and only the discounts received column total is posted to the general ledger.

Understanding a Cash Disbursement Journal

In some businesses, the cash disbursements journal is combined with the cash receipts journal and is referred to as the cash book. At the end of each accounting period (usually monthly), the cash disbursement journal column totals are used to update the general ledger accounts. When recording cash collections from customers it is quite common for the cash receipt journal to include a discounts allowed column. By using a discounts allowed column, the business can use the receipts journal to record the invoiced amount, the discount allowed, and the cash receipt. In this situation the line item postings to the accounts receivable ledger are for the full invoiced amount, and only the discounts allowed column total is posted to the general ledger. For example, suppose a business pays a supplier cash of 380 in respect of a purchase invoice of 400 less 5% cash discount.

What is your current financial priority?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Why You Can Trust Finance Strategists

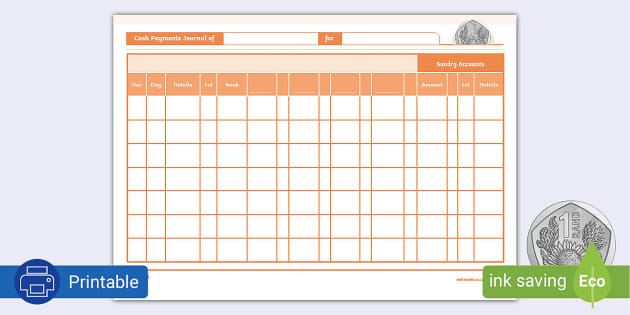

A cash payments journal is a special journal that records all the payments that an entity made by cash. A cash payment journal, also known as a cash disbursement journal, is used to record all cash payments (or disbursements) made by the business. If an entity uses an accounting system to record its accounting information, all financial transactions are records in the system by making journal entries.

Cash Receipts Journal is Updated from Source Documents

- Additionally in some businesses, the cash receipts journal is combined with the cash disbursements journal and is referred to as the cash book.

- Besides the above payments, refunds of cash arising from the return of goods by customers are also recorded in the cash disbursements journal.

- It helps businesses track their outgoing cash flow and manage expenses efficiently.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website.

At the end of each accounting period (usually monthly), the cash receipts journal column totals are used to update the general ledger accounts. As the business is using subsidiary ledger control accounts in the general ledger, the postings are part of the double entry bookkeeping system. On a regular (daily) basis, the line items in the cash disbursement journal are used to update the subsidiary ledgers.

In contrast the credit entry is to the accounts receivable control account in the general ledger, and represents the reduction in the amount outstanding from the credit sale customers. Had the cash receipt journal recorded other items such cash sales, fixed asset sales etc. then the credit would have gone to the cash payment journal adalah appropriate sales or fixed asset disposal account. Subsequently on a regular (usually daily) basis, the line items in the cash journal are used to update the subsidiary ledgers. Generally most cash receipts are from credit sale customers, and the subsidiary ledger updated is the accounts receivable ledger.

A cash payments journal is a specialized accounting journal used to record all cash disbursements, including payments made by check or in cash. It helps businesses track their outgoing cash flow and manage expenses efficiently. A cash disbursement journal is a record kept by a company’s internal accountants that itemizes all financial expenditures a business makes before those payments are posted to the general ledger.

The main benefit of using a cash payment journal is that it provides businesses with a record of all cash payments made. Additionally, the journal can be used to generate reports on spending, which can be helpful in budgeting and financial planning. Entries to the Accounts Payable account should be posted daily to the subsidiary accounts payable ledger. Its main objective is to make collect all the similar types of transactions together. The common cash payments transactions that record in this journal are paying to creditors, payments to suppliers, payments to the employee, and a fund that returns to customers.